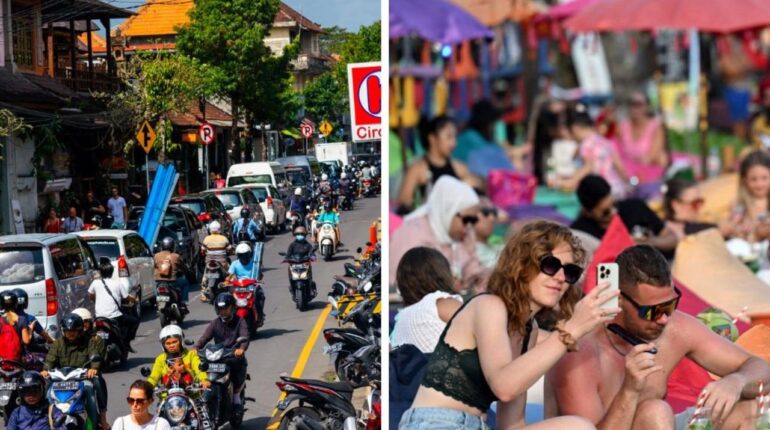

📌 Bali tourists face deportation threat: Only 35% paying mandatory $5 fee despite record revenue

Posted 8 July 2025 by: Admin

Bali’s Tourism Tax: The $5 Fee That’s Generating Millions

Bali’s modest $5 tourism tax is proving to be a financial goldmine. The 150,000 IDR levy, introduced in February 2024, has already generated IDR 168 billion in revenue during the first half of 2025 alone—approximately $11 million flowing directly into government coffers.

The numbers tell a compelling story of rapid revenue generation. Governor Wayan Koster revealed that on one record-breaking day, Bali collected IDR 933 million—a staggering $17,000 in tourism tax revenue within 24 hours. This single-day achievement demonstrates the sheer volume of international visitors willing to pay the mandatory fee.

The financial trajectory appears unstoppable. According to data from the Bali Provincial Government, if current collection trends continue, the island could potentially generate IDR 340 billion annually from the tourism tax alone. This projection transforms what initially seemed like a modest environmental initiative into a substantial revenue stream for the province.

The fee was originally positioned as a conservation measure, designed to « help protect Bali’s culture and customs, as well as protecting the island’s natural environment and sustainable tourism practices. » However, the impressive revenue figures suggest the tax has evolved into something far more significant—a major financial instrument capable of funding extensive preservation and development projects.

The rapid accumulation of tourism tax revenue reflects Bali’s enduring appeal as a destination. Every visitor contributes to this growing fund, whether they realize it or not. The seamless integration of the fee into the arrival process has created a consistent income stream that shows no signs of slowing down.

These millions in collected fees represent more than just numbers—they signal Bali’s successful transformation of tourism pressure into tangible funding for cultural and environmental protection. The question now becomes whether enforcement mechanisms can ensure every visitor contributes their share to this lucrative system.

Australian Tourists Lead The Charge Despite Low Compliance Rates

The reality behind those impressive revenue figures reveals a troubling compliance gap. Despite Bali’s financial success, only 35% of visitors actually paid the mandatory fee by the end of the policy’s first year—exposing a massive enforcement challenge that undermines the system’s potential.

Australians dominate Bali’s visitor statistics, with immigration data showing 344,639 Aussies descended on the island between January and March 2025 alone. This familiar pattern reinforces Australia’s position as Bali’s largest source market, with travelers consistently choosing the Indonesian paradise as their preferred tropical escape.

Yet this tourist loyalty creates a paradox. The same demographic driving Bali’s tourism boom is simultaneously contributing to the compliance crisis. Every unpaid fee represents lost revenue that could fund the cultural and environmental initiatives the tax was designed to support.

The mathematics are stark. If current visitor trends continue throughout 2025, hundreds of thousands of additional tourists will arrive. However, the 65% non-compliance rate means the majority will likely bypass the tourism tax entirely, leaving substantial revenue on the table.

The Bali Provincial Government’s optimistic projections of IDR 340 billion annually depend entirely on closing this compliance gap. Without stricter enforcement mechanisms, the tourism tax risks becoming a voluntary contribution rather than the mandatory levy it was intended to be.

Australian travel patterns suggest consistent demand for Bali experiences, regardless of additional fees. The challenge lies not in visitor willingness to pay—most tourists accept modest charges as part of travel costs—but in the system’s ability to capture payments before or upon arrival.

This compliance crisis represents more than missed revenue. It signals a fundamental weakness in Bali’s tourism management strategy. The island’s ability to balance visitor numbers with conservation funding depends on universal participation in the tourism tax system.

The enforcement gap becomes even more critical when considering the broader implications. Every unpaid fee compromises Bali’s capacity to protect the very cultural and environmental assets that attract millions of visitors annually.

Pay Up Or Face The Consequences: Entry Denials And Deportation Warnings

The compliance crisis has triggered a decisive response from Bali’s leadership. Governor Wayan Koster has abandoned diplomatic language, issuing stark warnings that non-payment will result in immediate and severe consequences for tourists who ignore the mandatory fee.

The governor’s enforcement strategy leaves no room for negotiation. Visitors who fail to pay face « consequences ranging from being denied entry to attractions, fines, or even deportation ». This escalation represents Bali’s most aggressive stance yet against tourism tax avoidance.

The threat of deportation marks a dramatic shift in enforcement philosophy. Previously treated as a minor administrative oversight, non-payment now carries the same weight as serious immigration violations. Airport officials have received clear directives to flag visitors without valid tourism tax payments.

Attraction entry denials will hit tourists where it hurts most—their vacation experiences. Popular destinations across Bali are implementing QR code verification systems, instantly identifying visitors who bypassed the tourism tax. No payment means no entry to temples, beaches, or cultural sites.

The governor’s collaboration with the hotel sector strengthens enforcement mechanisms considerably. Hospitality partners are being recruited as compliance enforcers, with properties potentially required to verify guest payments before check-in. This public-private partnership eliminates the traditional loopholes that allowed tourists to avoid the fee.

Koster’s approach reflects genuine frustration with the 65% non-compliance rate. The governor emphasizes that collected funds directly support environmental protection and cultural preservation programs. Every unpaid fee represents lost resources for the communities and ecosystems that make Bali an attractive destination.

The enforcement crackdown extends beyond individual tourists. Tour operators, travel agencies, and accommodation providers face scrutiny for enabling fee avoidance. This comprehensive approach targets the entire tourism supply chain, not just individual visitors.

The message is unambiguous: Bali’s patience with tourism tax non-compliance has expired. The island’s government has chosen enforcement over education, consequences over encouragement.

How To Pay And Why It Matters: Supporting Bali’s Cultural And Environmental Future

The enforcement warnings carry a simple solution: payment remains straightforward for travelers willing to comply. Bali’s government has streamlined the process to eliminate excuses for non-payment, offering multiple convenient options that take minutes to complete.

The Love Bali website provides the most efficient payment method before departure. Travelers need only their passport number and email address to complete the transaction. The system generates unique QR codes for individual visitors, while group travelers can select the ‘Group’ option to handle family and friend payments simultaneously.

Airport payment remains available at I Gusti Ngurah Rai International Airport, though some visitors complain about additional delays during arrival processing. The pre-departure online option eliminates this friction entirely, allowing tourists to bypass potential bottlenecks and proceed directly to immigration.

Each QR code serves as digital proof of compliance, instantly verifiable by attractions, hotels, and enforcement officials. The technology eliminates payment disputes while creating a seamless verification system across the island’s tourism infrastructure.

The fee’s purpose extends far beyond government revenue generation. Every 150,000 IDR contribution directly funds programs designed to « preserve the integrity and balance of Bali’s nature, its people, and their culture ». This investment model transforms tourists from passive consumers into active sustainability stakeholders.

Cultural preservation initiatives receive substantial funding through tourism tax revenue. Traditional ceremonies, temple maintenance, and artisan support programs depend on these contributions. Environmental protection projects, including waste management and ecosystem restoration, benefit from the consistent funding stream.

The tax represents a philosophical shift toward responsible tourism that balances economic benefits with cultural and environmental sustainability. Governor Koster’s collaboration with hospitality partners ensures funds reach communities and conservation programs rather than disappearing into administrative overhead.

The tourism tax creates a direct connection between visitor spending and destination preservation. Tourists who pay contribute to maintaining the authentic Balinese experience that attracts millions of visitors annually. Non-payment undermines the very foundation of Bali’s tourism appeal.

The choice is clear: contribute to Bali’s future or risk exclusion from its treasures.